Corestone Investment Managers AG is an independent, employee-owned partnership consisting of a multi-disciplinary team of seasoned investment professionals and a strong track record in money management & investment transaction advisory. As partnership, we are committed to our business and invest alongside with our clients. The company works and invests with entrepreneurs, family offices, medium-sized institutions & foundations.

It is our values and hard work that set us apart. Over time, we have developed a reputation for personalized high-quality output and outstanding results, both in terms of performance and client satisfaction.

When you need sound investment support and advice, turn to our team with years of experience and a name you can trust. We will be there for you every step of the way.

Founded in 2007, Corestone is based in Zug, Switzerland.

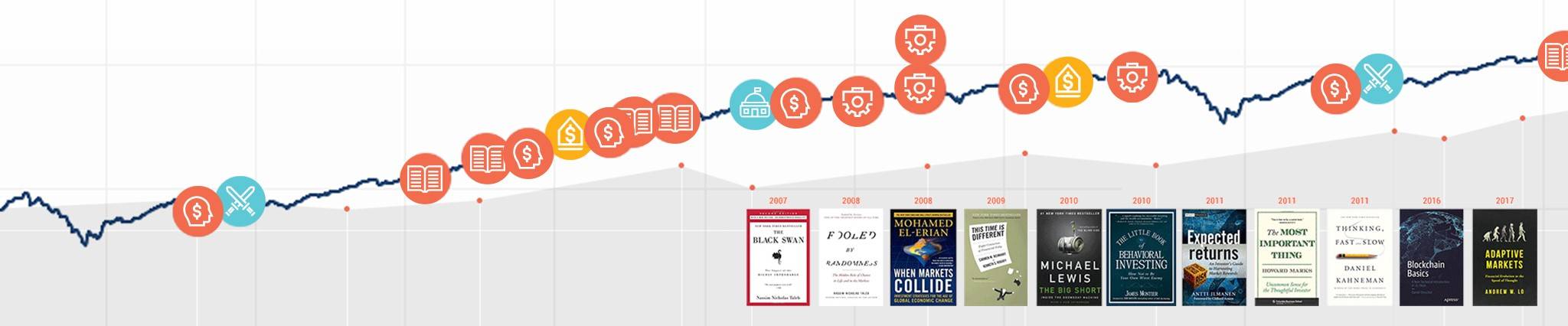

100 years of financial history at a glance!

The interactive bookshelf from Corestone Investment Managers provides summaries of groundbreaking financial literature from 1923 to the present that shaped financial markets. The infographic visualizes historical milestones, indices and developments of asset classes. Bookshelf is now publicly accessible and free of charge.

Who we are

Trusted Partner

As partnership, we are committed to our business and invest alongside with our clients. Corestone is acting as a true fiduciary, and is fully aligned with its clients – it is large enough to manage a diverse client base, yet with a governance and corporate structure that is nimble to deliver personalized client service.

Distinctive investment approach

We believe in a disciplined and systematic approach to investing, combining the best attributes of active and passive management. We provide the same investment quality and sophistication as large institutional investors to all our clients.

Proven performance

Corestone has developed a reputation for high quality output and outstanding results, both in terms of performance and client satisfaction.

What we do

Corestone offers its expertise to entrepreneurs, principal investors and private clients and works with clients in various arrangements. As investment firm we are focused to deliver superior investment performance and customer service to meet set goals. As partnership we co-invest along with our clients in selected investments & transactions.

Get in touch and we would love to tell you more about how we can work together.

Achieving Investment Excellence

What does it take to be a successful long-term pension investor? Alfred Slager and Jaap van Dam provided an evidence-based, readily applicable framework in this event organized by the CFA Society Switzerland and Corestone.

WaldParcours gewinnt ASSA-Preis

Der von Corestone geförderte WaldParcours wurde im Rahmen der ASSA-Kampagne Nachhaltigkeit im Sport ausgezeichnet.

Canada as a model for Swiss pension funds?

Fewer pension funds in Switzerland could lead to greater returns and professionalism, as the example of Canada shows.